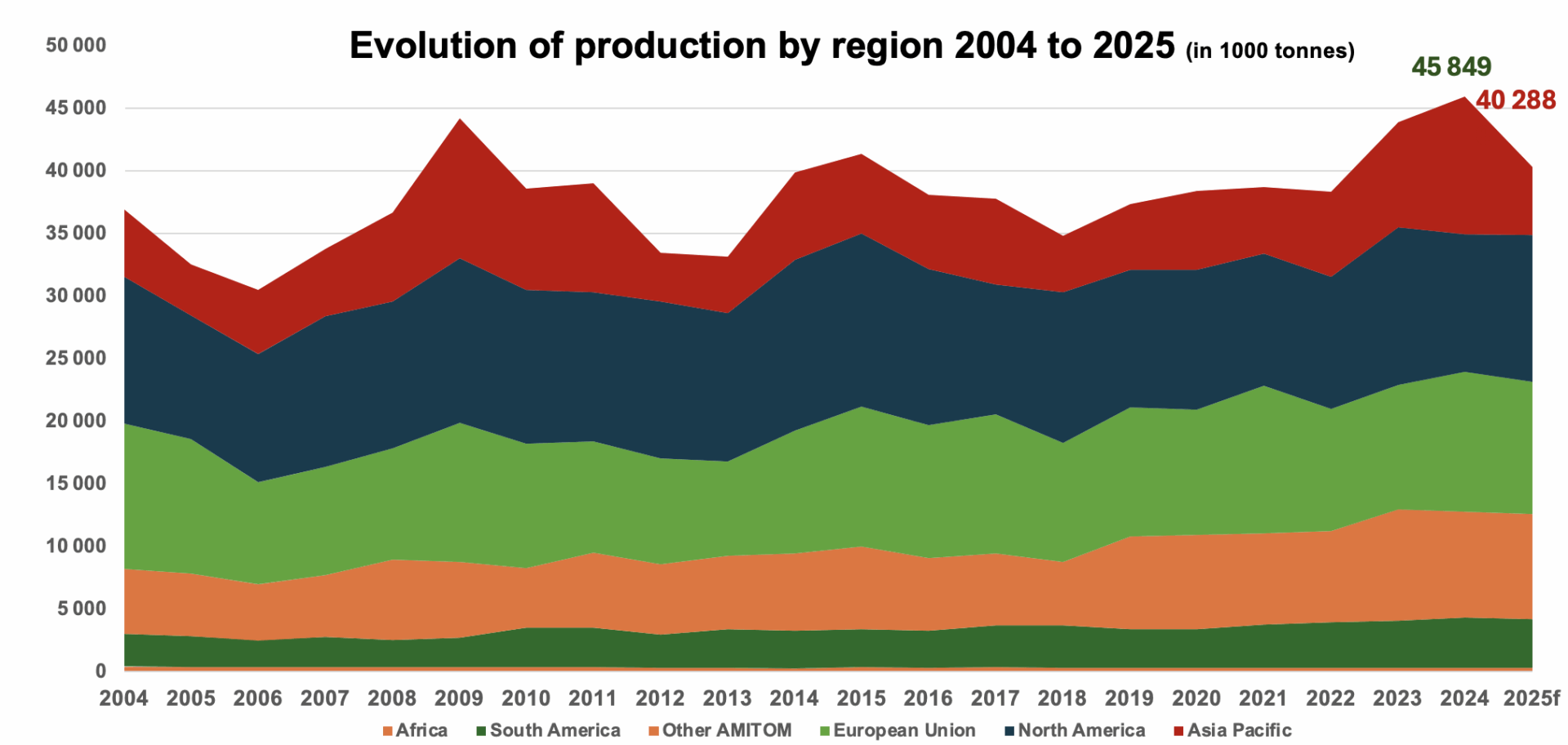

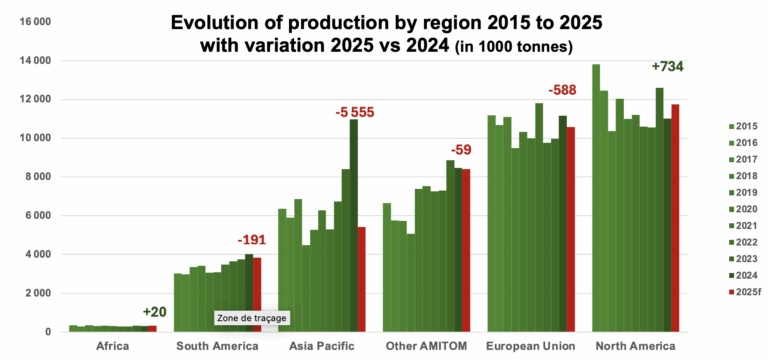

WPTC members during their Board meeting and the 2025 Tomato News Conference on 5 October 2025 established the preliminary world production estimate for 2025 at just below 40.3 million tonnes, down 12% from the 45.8 million tonnes processed globally in 2024.

Amitom countries

Bulgaria

Egypt

The Summer Season was exceptional this year in particularly for color achieving +2.2 in final products. There were many days with high temperatures in average +40° (as it become the norm every year) which put pressure on the ripening of fresh tomatoes, and also advancing the maturity of some quantities from the next Nili Crop in some areas “that were supposed to start in October”. This eventually pressured the daily supply of tomatoes to factories to oversupply level on many days.

Summer harvesting finished on 20th September and now it is a transition period till next season (Nili Crop). Harvesting of Nili crop shall start from the second week of November till the end of December, while the Winter Crop (in southern governorates) starts from January till April.

For now the forecast of 780,000 tonnes is maintained for the year 2025 (Egypt crop is throughout the year, from January with the the beginning of Winter Crop till the end of Nili crop in December).

The initial forecast for 2026 is 800,000 tonnes.

France

Greece

Hungary

The season ended last week, with excellent harvest averages and very good quality (average brix at Univer was 5.5, a historical best). According to the previous forecast, this year’s processing season closed with a higher quantity, approximately 97,000 tonnes, of which two-thirds for Univer and one-third for Aranyfácán.

The weather was typically favourable for tomatoes after the cooler May, apart from the drought, but producers had the necessary capacities for irrigation. The dry weather helped to avoid crop protection problems. Therefore this year’s harvest was outstanding in both quality and quantity. The average yeild was 97 t/ha, an outstanding result from about 1,000 ha.

Iran

Israel

No new data

Italy

In the North, the last official figures show that as of 21 September, 2.85 million tonnes had been processed of which 350,000 tonnes in the last week (week 38), with an average brix of 5.05, 4.9% penalties and a payment index of 101%.

In the last week (week 39) very small volumes were processed due to widespread rains, especially in the West, with around 80 mm in some areas. The weather is better this week and harvesting has fully resumed. The season is however nearing the end with many factories already closed and the others closing at the end of the week. Only one factory is expected to operate next week. The total forecast is now 3.025 million tonnes.

In the Centre and South, the weather in September has been very good, better than average, and the volume processed is higher than expected, notably for the long varieties. Quality remains good, with good colour although brix levels have decreased as is normal for the season. Many factories closed at the end of September although some are still running. The expectation is now 2.675 million tonnes, bringing the total for Italy back to 5.7 million tonnes.

Portugal

Late spring rains forced planting to start later than usual: instead of the end of March, it could only be normalized from May onwards. Stable weather conditions allowed this operation to continue until the second week of June.

Due to delayed transplanting, harvesting and processing could only begin in week 32, with just two factories in operation. In week 33, most processors started running at reduced speed, gradually increasing their daily capacity between the end of week 32 and the beginning of week 34. From week 35 onwards, a few were operating at 50%, while the remaining units gradually reached full capacity.

In this campaign, not all units were able to operate at full capacity, as the early fields produced low yields, with volumes only improving from week 35 onwards. Although the initial estimated volume for Portugal is expected to show a decline, some processors will achieve their production targets.

Overall, the ongoing crop has demonstrated very good quality results in the majority of processing units.

Although this crop presented unique characteristics due to delayed transplanting and harvesting – occurring approximately two weeks later than usual – the quality of Portuguese production was not compromised. Portuguese tomatoes are renowned for their balanced sugar-to-acid ratio and, in particular, for their strong colour. In the 2025 crop, this attribute was further enhanced, with consistently high values recorded throughout the season.

On the other hand, the lower Brix value of the fresh tomato had a negative impact on processing efficiency.

The last two weeks have been quite good for the time of the year with one very good week followed by some rain on27-28 September which was not significant and only slowed operations temporarily. The weather is currently good with temperatures of 27-28 °C with nights at 15-17°C.

As of 28 September, 82% of the forecast of 1.3 million tonnes had been achieved, and there are still significant volumes to be harvested. The harvest is now slowing down and the season should end around 15-16 October. Quality remains good with good colour and brix around 5°.

Spain

The season is nearly over in Andalusia with only one factory still running.

In Extremadura factories in the vegas Altas have all closed and the season should end around 13/14 October in the Begas Bajas where there was a peak in production last week.

In the North, the harvest is going well. Factories are still at full capacity and should operate until 20th October.

The overall forecast remains 2.4 million tonnes, down from the first estimate of 2.6 million tonnes.

Tunisia

Turkey

Ukraine

Other WPTC countries in the Northern Hemisphere

California

This season has been a record for California. It is a “Unicorn Season” something we have heard could exist, but have never experienced or seen with our own eyes, until this season.

A few key factors (not all):

• The reduction of acreage meant plantings were on the very best soils

• Water availability

• Excellent Weather, during planting, throughout the Spring ,during bloom, crop development, and during harvest.

• The extreme high temperatures that were experienced over the last few seasons didn’t happen this year.

This all translated to very little stress for the crop at any point in the season. This allowed for a 18.75% increase in yield from our historical 5 year average. In consequence, the production estimate has been raised to 11.75 million short tons, 10.65 million metric tonnes.

Canada

China

The total volume in China is about 4.9 million tonnes, including 3.02 million tonnes in Northern Xinjiang, 1.07 million tonnes in Southern Xinjiang, 0.76 million tonnes in Inner Mongolia, and 60,000 tonnes in Gansu-Ningxia.

In the Inner Mongolia region, 20% of the planting area was severely affected by heavy rains and floods from July to August, causing a significant production decline.

82 factories were running, a decrease of 24 compared to the 2024 crop, equivalent to the 2020 level. The daily capacity is 214,000 tonnes, a decrease of 60,000 tonnes compared to 2024 (-22%).

The 2025 season has been shortened by 22 days compared with 2024, only 50% of full capacity.

Up to on 30th September,the raw material price for China in 2025 is 67 USD/t. This is an increase of 2 USD/t compared to May 2025, but compared to 2024, it dropped by 9 USD/t.

Compared to 2024,the cumulative trade figures over eight months in China were gradually tending to incease. The total export of bulk and repack tomato products (HS CODE 200290) was 0.77 million tonnes, a year-on-year increase of 3% compared to 2024. and the total of bulk was 0.46 million tonnes, a year-on-year increase of 10% compared to 2024.

It is estimated that the volume will reach 6 to 7 million tonnes in 2026, primarily due to:

– Considering the natural growth of the market.

– The reasonable production level for China is between 6-8 million tonnes over the past 20 years.

– The 2025 production fell significantly below the level.

Japan

Other WPTC countries in the Southern Hemisphere

Argentina

The total harvested area for 2025 reached 7,300 hectares, with a production output of 620,250 processed tonnes. Record yields were achieved for early- and mid-season tomatoes, while late-season tomatoes recorded average yields.

For the 2025/26 season, plantations have begun with fewer wind-related issues than usual. Nationwide, a reduced planted area of approximately 6,000 hectares is expected, with a projected production of 550,000 tonnes. Currently, one-third of the planned area has been planted. The milder winter has raised concerns about potential pest pressure on early-season tomatoes, as pests are likely to have survived on overwintering hosts.

The reduction in planted area can be attributed to several factors: stock levels in domestic processing plants, slower market demand, and increased competition from tomato paste imports from Chile and China. These conditions have led growers to scale back on planting for the current season.

Australia

Brazil

We had a turbulent start to the harvest season regarding ripening, which initially began with good color but lasted for a very short time, with July and August being significantly impacted by green fruit and productivity losses.

There is a climate consensus that the first semester had no occurrence of intense cold, which favored the ripening of the initial areas. However, starting June 20th, we experienced a significant drop in average temperatures that extended until the end of August, thus bringing substantial ripening delays, consequent harvest delays, and excessive discarding of green fruit in some situations, contributing to even sharper productivity declines. The numbers indicate a 14% reduction compared to the 2024 harvest. A 7% reduction compared to the last estimate made.

The trend for 2026 is the stability of production volume and area at 2025 levels.